Uob One Card Rebate Exclusion

While the annual fee of s 192 6 is only waived the first year the rebate potential of uob one card and uob smart rebate programme combined offers an easy way to quickly and conveniently recoup the cost.

Uob one card rebate exclusion. Uo one ard shall refer to the uob one classic card and uob one platinum card issued by uobm. There are no changes to the cash rebate amount and spend tiers. The credit card owes its fame to its key proposition. 7 506 1 21 7 216 29 51 1 82 21 5 2yhuylhz 7khvh whupv dqg frqglwlrqv dsso wr wkh 82 21 dug fuhglw fdugv lvvxhg e wkh 8qlwhg 2yhuvhdv dqn.

With effect from 1 aug 2016 the annual fee for uob one card will be revised to s 192 60 for principal card and s 96 30 inclusive of gst for. Provided that the cardholder achieves this minimum spend for 3 consecutive months within a qualifying quarter. Weekday ash rebate shall be applicable for all spend and payments made from 12 00 am on monday to 11 59 pm on friday. Note that a minimum of 5 transactions must be achieved in a statement period in order.

The uob one card is hands down uob s favourite entry level credit card especially for those with a uob one account too. Enjoy up to 5 cash rebate on all retail spend including bill payments and overseas spend with uob one card. Are there any other changes to the uob one card quarterly cash rebate. As such in a statement stop using uob one credit card for grab top up once the change comes into effect mid march.

Yes the exclusions are applicable to both existing uob one card members and new uob one card members. Ultimately uob one card is best for average consumers with a consistent budget seeking to maximise rewards and offset their future purchases. A maximum of 5 cash rebate on everything no need to futz about with different spending categories. Change your grab car and grab food payment method to credit card to get the rebate.

More about the promotion. If the cardholder achieves a minimum spend of 2 000 per month the cashback is immediately bumped up to a tantalising 5. A merchant category code mcc is a four digit number assigned to a business by the merchants acquiring bank that is providing the credit card terminal. 5 from uob one credit card bonus rebate cap at 100 month.

Simply spend a minimum of s 500 s 1 000 or s 2 000 with at least 5 transactions per statement month for each qualifying quarter. Enjoy up to 5 cash rebate on all spend best petrol savings at caltex and spc and up to 20 smart rebates and 3 33 deposit interest rate on uob one account. Cardmember shall mean both the principal and supplementary cardmembers who have a uob one card. And 50 100 300 quarter when you hit specific spending milestone.

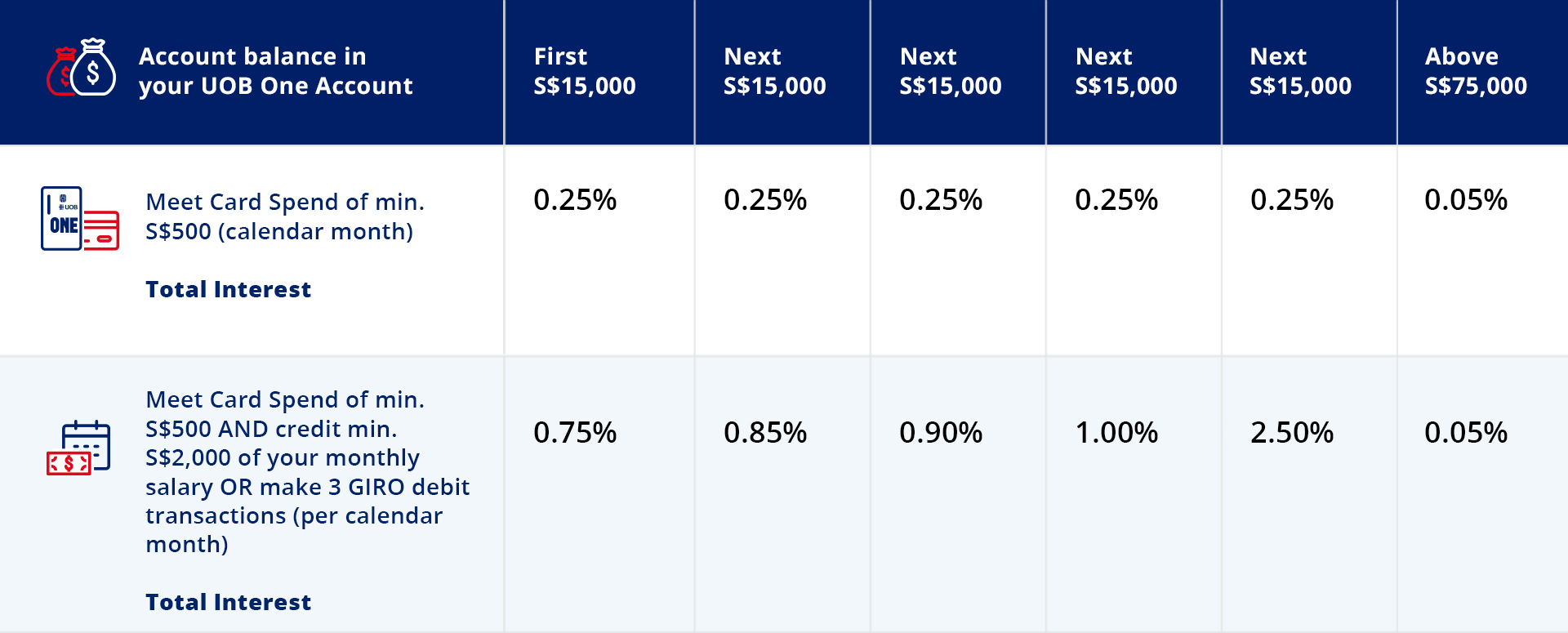

The uob one credit card rewards 3 33 cash back for a minimum spend of 500.